Last Updated: August 6, 2025 | Author: Shahalam , Analyst at Pariksha Soochna

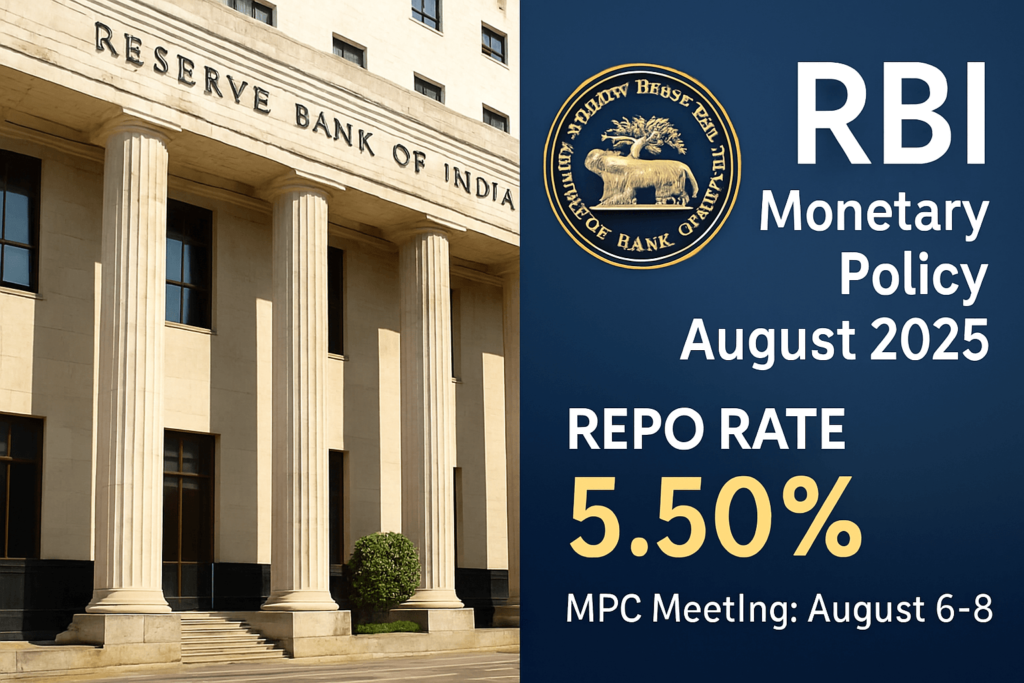

RBI Monetary Policy August 2025: Repo rate unchanged at 5.50%, inflation forecast revised to 3.1%.

Quick Summary — RBI Monetary Policy Committee Meeting Highlights

The Reserve Bank of India (RBI), in its latest RBI Monetary Policy Committee (MPC) meeting held from August 4–6, 2025, decided to keep the repo rate unchanged at 5.50%, maintaining a neutral policy stance.

- Repo Rate Today: 5.50% ✅ (unchanged)

- Reverse Repo Rate: 3.35%

- RBI Policy Outlook: Neutral

- Inflation Forecast: Cut to 3.1% for FY26

- GDP Growth Projection: 6.5% for FY26, 6.6% for FY27

- RBI Governor: Sanjay Malhotra

RBI Policy Date & Key Decisions

The RBI policy date for this MPC was August 6, 2025, when Governor Sanjay Malhotra announced the decisions live.

Main Announcements from the RBI Monetary Policy Today

- Repo Rate (the rate at which RBI lends to commercial banks) stays at 5.50%.

- No RBI rate cut despite easing inflation — indicating a cautious approach.

- CPI inflation forecast revised down from 3.7% to 3.1% for FY26.

- GDP outlook remains steady at 6.5% for FY26.

- Liquidity management — RBI panel recommends Weighted Average Call Rate (WACR) as the main operative target for monetary policy.

| Join Our WhatsApp Channel | Follow here |

| Join Our Facebook Community | Follow here |

Why RBI Held the Repo Rate Steady

The RBI Governor explained that the decision was based on:

- Inflation under control and trending downward

- Global uncertainties such as trade tensions and US tariffs

- Previous rate cuts (100 bps) still being transmitted to the economy

- The need to balance growth with price stability

📌 Keyword Insight: Many were expecting an RBI rate cut, but the repo rate today remains unchanged, signaling stability.

RBI Monetary Policy Impact on Markets — Sensex Today & Nifty

Following the RBI Monetary Policy Committee meeting, Sensex today saw mild volatility and ended slightly lower as traders adjusted to the “dovish pause” tone.

- Banking stocks held steady as no immediate rate cut was announced.

- Export-oriented sectors remained cautious due to global tariff uncertainties.

Inflation & Growth Outlook

Inflation

- FY26 inflation projection lowered to 3.1%

- Indicates comfortable price levels for consumers and businesses

GDP Growth

- GDP growth maintained at 6.5% for FY26 and 6.6% for FY27

- RBI sees steady demand and investment activity despite global risks

What This Means for You

- Loan EMIs: No change in housing, car, or personal loan rates for now.

- Investors: Stability in interest rates supports equity markets in the medium term.

- Savers: FD rates likely to remain stable in the near term.

RBI Monetary Policy Live Updates Timeline

| Date | Event |

|---|---|

| Aug 4–6, 2025 | MPC meeting held |

| Aug 6, 2025 | RBI policy news announced by Governor |

| Next MPC Date | October 2025 (tentative) |

Repo Rate Today — Historical Trend

| Date | Repo Rate |

|---|---|

| Aug 2024 | 6.00% |

| Feb 2025 | 5.75% |

| May 2025 | 5.50% |

| Aug 2025 | 5.50% |

MPC (Monetary Policy Committee) Meeting Composition

- Governor: Sanjay Malhotra (Chairman)

- Other members: RBI deputy governors & external experts

- Decision: Unanimous to keep rates unchanged

RBI Monetary Policy Outlook — The Road Ahead

- RBI is likely to monitor global economic shifts before making a rate cut.

- Liquidity will be managed using VRRR/VRR auctions.

- Inflation risks from food prices and global oil remain in watch mode.

FAQs

Q1: What is the repo rate today?

A1: The repo rate today is 5.50%, unchanged after the August 2025 RBI MPC meeting.

Q2: When is the next RBI policy date?

A2: The next MPC meeting is expected in October 2025.

Q3: Did RBI cut rates this time?

A3: No, there was no RBI rate cut in the latest meeting.

Q4: How will this affect my EMIs?

A4: No immediate change — EMIs will remain the same.

Q5: Who is the current RBI Governor?

A5: Sanjay Malhotra is the RBI Governor.

Conclusion

The RBI policy today signals monetary stability — with no change in the repo rate, a lowered inflation forecast, and steady growth outlook. This cautious stance ensures price stability while supporting economic momentum. As global uncertainties evolve, the RBI meeting in October will be the next big watch point for possible policy shifts.

Pingback: UPSC CAPF AC 2025 Answer Key – Overview - Pariksha Soochna-Your perfect guide to government exams